The digital finance landscape is undergoing a seismic shift, and small businesses are at the forefront of this transformation. Traditional banking systems, with their hidden fees, slow processing times, and bureaucratic hurdles, have long hindered entrepreneurial growth. Enter coyyn.com business—a groundbreaking platform that’s rewriting the rules of financial management for small enterprises worldwide.

Understanding Coyyn.com Business: A New Era of Financial Control

Coyyn.com operates as a comprehensive decentralized finance platform that uses blockchain technology to let users control their financial operations without traditional banks or central institutions. This isn’t just another fintech app; it’s a complete ecosystem designed to give small business owners unprecedented control over their money.

Unlike conventional banking systems where institutions act as gatekeepers, the coyyn com business app eliminates intermediaries entirely. The platform integrates secure transactions, smart contracts, and multi-asset support, enabling businesses to monitor payments, manage digital assets, and maintain compliance from a centralized location.

The Core Philosophy

The fundamental principle driving coyyn.com business is simple yet revolutionary: financial power should belong to those who earn it. By leveraging decentralized finance (DeFi) principles, the platform addresses critical pain points that have plagued small businesses for decades—excessive fees, delayed payments, limited access to global markets, and complex regulatory requirements.

Key Features Transforming Small Business Finance

1. Decentralized Wallets: Your Money, Your Control

Decentralized wallets form a core component, allowing users to store, send, and receive digital assets independently without central authority control. This means:

- Complete ownership of your funds with private key control

- Enhanced privacy with no central servers vulnerable to large-scale breaches

- Instant setup that integrates seamlessly with other platform features

- Multi-currency support for handling diverse payment types

For a small business managing international contractors or clients, this eliminates the trust issues inherent in traditional banking while providing complete financial oversight.

2. Smart Contracts: Automation That Works for You

Smart contracts are code-based agreements that execute automatically when preset conditions are met, eliminating the need for lawyers or banks and significantly reducing costs and processing time.

Practical Applications:

| Business Need | Smart Contract Solution | Benefit |

|---|---|---|

| Freelancer payments | Auto-release funds upon project completion | No manual processing, instant payment |

| Supplier agreements | Payment triggers upon delivery confirmation | Reduced disputes, transparent terms |

| Escrow services | Funds held until conditions verified | Enhanced trust, no intermediary fees |

| Subscription billing | Automatic recurring charges | Improved cash flow, reduced admin |

| Loan repayments | Scheduled auto-payments | Simplified compliance, no missed payments |

The platform makes these sophisticated tools accessible even to business owners without technical expertise, democratizing financial automation that was once available only to large corporations.

3. Multi-Asset Support: Flexibility in a Digital World

The platform enables handling multiple types of digital currencies—including Bitcoin, Ethereum, and stablecoins—in one location without switching applications. This versatility allows small businesses to:

- Build diversified portfolios with reduced risk exposure

- Accept customer payments in various cryptocurrency forms

- Convert assets internally, avoiding external exchange fees

- Execute cross-chain transfers smoothly between different blockchain networks

Consider a small retail business accepting international orders. With coyyn.com business, they can receive cryptocurrency payments and instantly convert them to stable funds, eliminating currency conversion fees and delays that typically eat into profit margins.

4. Automated Invoicing and Expense Tracking

Automated invoicing allows users to create and send bills with just a few clicks, with built-in payment reminders that accelerate cash flow and reduce late payments. The system also tracks expenses by category, providing clear visibility into spending patterns each month.

This feature alone saves small business owners countless hours previously spent on manual bookkeeping and payment follow-ups.

How Coyyn.com Business Solves Real-World Problems

Breaking Down Financial Barriers

Traditional banking creates numerous obstacles for small businesses:

Problem: High international transfer fees (typically 5-10% for cross-border payments)

Coyyn Solution: International transfers cost only 0.5-2.1%, with domestic transfers over $100 completely free

Problem: Slow payment processing (days or weeks for international transfers)

Coyyn Solution: Transactions clear in seconds rather than weeks, significantly improving cash flow and enabling faster reinvestment

Problem: Limited access to advanced financial tools

Coyyn Solution: Enterprise-grade features available to businesses of all sizes through scalable pricing tiers

Problem: Complex regulatory compliance

Coyyn Solution: Built-in regulatory tools monitor transactions for compliance with tax laws, anti-money laundering requirements, and other regulations specific to each jurisdiction

Industry-Specific Applications

The versatility of coyyn.com business extends across multiple sectors:

E-Commerce

Online merchants gain access to cryptocurrency payment capabilities, integrated inventory oversight, and real-time performance metrics through personalized control panels. The platform creates unbreakable audit trails that make compliance and financial reporting straightforward.

Logistics and Supply Chain

Smart contracts automate delivery payments and fund releases, while blockchain records provide transparent shipment tracking, enabling businesses to pay suppliers automatically upon proof of arrival. This dramatically reduces delays and fraud while managing global routes efficiently.

Real Estate

Property transactions benefit from escrow contracts that close automatically when conditions are met, with blockchain ensuring fair, immutable records of all transactions and agreements.

Freelance and Gig Economy

Freelancers can receive payments in both cryptocurrency and traditional currency, with instant transfers that significantly reduce typical payment delays and associated fees. The coyyn com business app’s mobile version enables workers to track jobs, invoice clients, and manage tax obligations on the go.

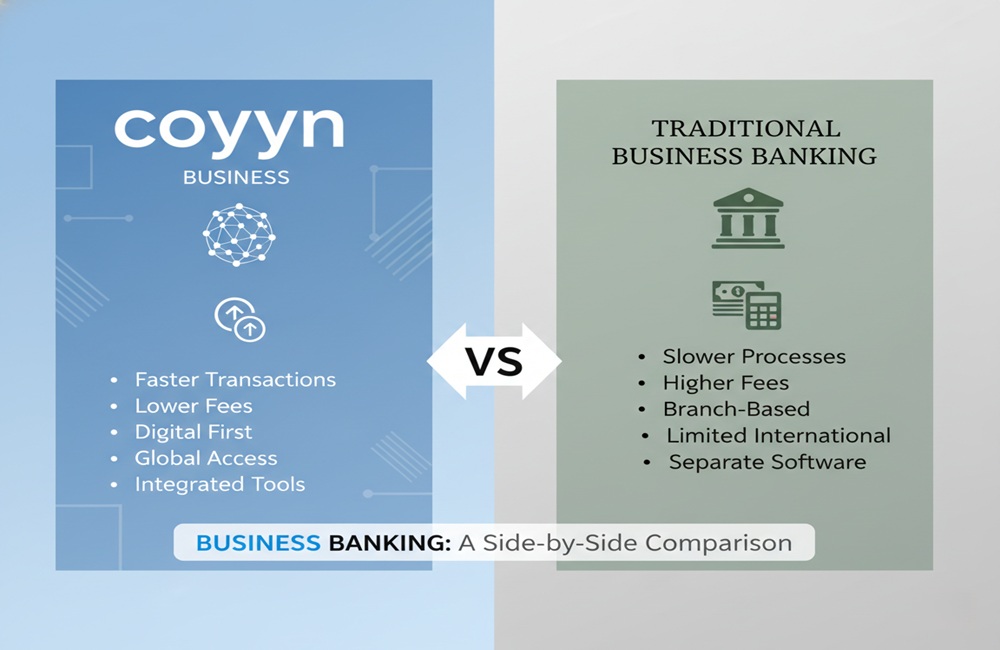

Comparing Coyyn.com Business to Traditional Banking

| Feature | Traditional Banks | Coyyn.com Business |

|---|---|---|

| International transfer fees | 5-10% | 0.5-2.1% |

| Domestic transfer fees | $15-45 per wire | Free over $100 |

| Processing time | 3-5 business days | Seconds |

| Operating hours | Limited branch hours | 24/7 access |

| Account setup | Weeks with extensive paperwork | Minutes with digital verification |

| Multi-currency support | Limited, high conversion fees | Extensive, low-cost conversions |

| Smart contract capability | Not available | Fully integrated |

| Blockchain transparency | Not applicable | Complete transaction visibility |

| Global accessibility | Geographic restrictions | Borderless operations |

Security and Compliance: Built on Trust

Security concerns often prevent businesses from adopting new financial technologies. Coyyn.com business addresses this through multiple layers of protection:

Encryption Standards

The platform employs advanced encryption and two-factor authentication to safeguard sensitive information from unauthorized access, ensuring that financial data remains protected at all times.

Blockchain Security

Multiple security layers defend digital assets, with encryption technology shielding sensitive information and blockchain’s permanent record-keeping preventing unauthorized modifications. This creates an immutable audit trail that enhances accountability.

Regulatory Compliance

The platform doesn’t just secure transactions—it helps businesses stay compliant. Built-in monitoring tools check transactions against relevant regulations, generating reports and alerts for potential compliance issues before they become problems.

The Economic Impact: Real Savings, Real Growth

The financial benefits of switching to coyyn.com business extend far beyond simple fee reductions:

Direct Cost Savings

One small exporter reported saving $5,000 annually on supplier wire transfers alone. When you factor in reduced administrative time, eliminated intermediary fees, and faster payment processing, the total savings multiply significantly.

Hidden Efficiency Gains

The platform’s analytics capabilities help businesses identify waste, with one retailer discovering $10,000 in overpayments to vendors and unused subscriptions. These insights enable data-driven decision-making that continuously optimizes operations.

Scalability Without Growing Pains

Built-in scalability allows businesses to start small and add features as they grow, with cloud technology handling traffic spikes—like Black Friday rushes—without system crashes. This means the platform grows with your business rather than requiring costly migrations to enterprise solutions.

Improved Cash Flow

Instant payment processing and automated invoicing with built-in reminders dramatically improve cash flow. Money that previously sat in transit for days or weeks can now be immediately reinvested in inventory, marketing, or growth initiatives.

Getting Started: A Practical Guide

The barrier to entry for coyyn.com business is remarkably low:

Step 1: Account Creation

Visit coyyn.com and click “Business Account,” entering basic information like email and company name—the entire process takes approximately two minutes.

Step 2: Verification

Upload identification and business documentation, with AI-powered verification typically completing within hours rather than the days or weeks required by traditional banks.

Step 3: Setup and Configuration

Choose your preferred features based on business needs. The platform offers guided setup for wallets, payment processing, invoicing systems, and integration with existing tools.

Step 4: Integration

The platform excels in integration capabilities, working seamlessly with existing business tools and eliminating the clunky setups that plague many financial systems.

Pricing Structure

The coyyn com business app offers flexible pricing designed for scalability:

- Basic Tier: $15/month – Essential features for solo entrepreneurs and micro-businesses

- Professional Tier: $30/month – Advanced analytics and automation for growing businesses

- Enterprise Tier: $45/month – Full feature set including custom integrations and dedicated support

- Free Trial: Risk-free testing period to evaluate platform fit

User Experience: What Business Owners Are Saying

User satisfaction rates reach 90% for ease of use and support quality, with 24/7 live chat providing quick problem resolution. Real users have shared compelling testimonials about their experiences.

One freelancer stated that the platform “turned my freelance hustle into a steady stream,” highlighting how the financial tools transformed unpredictable gig work into reliable income.

Small business owners particularly appreciate the elimination of manual payment tracking and the independence from slow traditional banking channels, which makes managing freelancers and multiple projects significantly more efficient.

The Future of Small Business Finance

The trajectory of coyyn.com business points toward an increasingly decentralized financial future. The platform predicts that Web 3.0 will capture 35% of the gig market by the end of 2025, with decentralized systems enabling workers to own more of their data.

Emerging Features

The platform continues to evolve based on user needs:

- DAO Integration: Giving team members voting power on project decisions through decentralized autonomous organizations

- Enhanced AI Analytics: Deeper predictive insights for forecasting revenue and identifying growth opportunities

- Expanded Asset Support: Continuously adding support for new cryptocurrencies and digital assets

- Mobile-First Enhancements: Improved mobile functionality for the growing number of entrepreneurs managing businesses from smartphones

Addressing Challenges

No platform is perfect, and coyyn.com business acknowledges areas for improvement:

Income Stability Tools

The platform addresses freelancer concerns about irregular income by offering tools for hybrid work models that combine gig work with steady employment. Features include automatic tax savings allocation and income forecasting.

Well-Being Features

Recognition that business success requires personal well-being has led to integrated features like work-break reminders and mental health resources.

Education and Support

Comprehensive learning resources and dedicated support teams ensure smooth onboarding, addressing the concern that staff may require training to fully utilize platform capabilities.

Why Small Businesses Are Making the Switch

The decision to adopt coyyn.com business ultimately comes down to competitive advantage. In an increasingly digital and global marketplace, businesses using outdated financial infrastructure face significant disadvantages:

Speed Matters

When competitors can process international payments in seconds while you wait days or weeks, that delay translates directly to lost opportunities and reduced competitiveness.

Cost Efficiency Compounds

Saving 5-8% on every international transaction might seem modest, but over months and years, these savings enable significant additional investment in marketing, inventory, or expansion.

Automation Frees Resources

Time spent on manual invoicing, payment tracking, and financial reconciliation is time not spent serving customers, developing products, or growing the business.

Data-Driven Decision Making

The platform’s emphasis on data-driven decision making has been shown to significantly improve business outcomes, with data-driven organizations demonstrably more successful at customer acquisition, retention, and profitability.

Considerations Before Adopting

While the benefits are substantial, businesses should consider certain factors:

Learning Curve

Although the interface is designed for accessibility, staff members may require introductory instruction, and the platform supplies thorough learning resources alongside dedicated support teams to ensure smooth onboarding.

Regulatory Landscape

Regulatory updates demand consistent monitoring across all operating jurisdictions. While the platform provides compliance tools, businesses remain responsible for understanding regulations in their specific locations.

Digital Asset Considerations

Some businesses note the absence of FDIC insurance on cryptocurrency components. However, for digitally-savvy firms comfortable with digital assets, the benefits typically outweigh this consideration.

Hybrid Approach Option

Many businesses don’t immediately switch entirely from traditional banking. Instead, they use coyyn.com business for specific functions—international payments, contractor management, cryptocurrency transactions—while maintaining traditional accounts for other purposes.

The Competitive Edge in 2026 and Beyond

By providing transparency, scalability, and ease of integration with enterprise systems, the platform redefines digital business management standards, making it the choice for forward-thinking companies operating in today’s financial landscape.

Small businesses face unprecedented opportunities in the global digital economy, but capitalizing on these opportunities requires modern financial infrastructure. Traditional banking systems, designed for a pre-internet world, create friction at every turn—friction that manifests as fees, delays, complexity, and limited access.

Coyyn.com business removes that friction. It provides small businesses with the same sophisticated financial tools previously available only to large corporations, but with pricing and accessibility designed for entrepreneurs.

The question for small business owners isn’t whether digital financial transformation will happen—it’s whether your business will lead that transformation or struggle to catch up. Early adopters of platforms like coyyn.com business gain advantages that compound over time: lower costs, faster operations, better data, and the agility to capitalize on emerging opportunities.

Conclusion: The New Financial Reality

The way small businesses manage money is fundamentally changing. The platform’s goal is making finance open and fair for everyone, fixing issues in legacy systems like hidden costs and slow processes. For entrepreneurs and small business owners, this isn’t just about saving money on transaction fees—though that alone justifies consideration.

This is about gaining control over one of the most critical aspects of business operations: financial management. It’s about accessing global markets without prohibitive fees. It’s about automating processes that previously consumed hours each week. It’s about making informed decisions based on real-time data rather than month-old bank statements.

Coyyn.com business represents a bridge between the financial world we’ve known and the decentralized future we’re building. For small businesses willing to embrace this change, the rewards—in efficiency, savings, growth, and competitive advantage—are substantial and immediate.

The revolution in small business finance has begun. The only question is: will you be part of it?

Frequently Asked Questions

Is coyyn.com business suitable for traditional brick-and-mortar businesses?

Yes. While the platform excels in digital operations, traditional businesses benefit significantly from reduced payment processing fees, automated bookkeeping, and efficient supplier payments.

How secure is storing business funds on the platform?

The platform uses advanced encryption, two-factor authentication, and blockchain security. However, businesses should implement proper security practices including secure password management and regular security audits.

Can I integrate coyyn.com business with my existing accounting software?

The platform offers robust API integration capabilities that work with most major accounting systems. Specific integrations should be verified during setup.

What happens if I need to return to traditional banking?

The platform allows fund withdrawals to traditional bank accounts. Many businesses maintain hybrid operations using both systems as they transition.

Does coyyn.com business require cryptocurrency knowledge?

No. While cryptocurrency support is available, businesses can operate entirely with traditional currency if preferred. The platform makes crypto accessible to those interested while not requiring it.

What customer support options are available?

24/7 live chat support, comprehensive documentation, video tutorials, and dedicated account managers for enterprise tier customers.

How does the platform handle taxes and reporting?

Built-in reporting tools generate transaction records formatted for tax purposes. The platform tracks expenses by category and provides export functionality for accountants. However, businesses should consult tax professionals for specific guidance.

What’s the minimum business size to benefit from the platform?

Solo entrepreneurs and freelancers can benefit from the basic tier. The platform scales appropriately for businesses from single-person operations to substantial enterprises.