The rapid expansion of remote work has fundamentally transformed how businesses operate globally. Companies now hire talent from across continents, creating diverse teams that drive innovation and productivity. However, this global workforce brings a significant operational challenge: managing cross-border payments efficiently and cost-effectively. Enter coyyn.com business—a digital finance platform designed to address the complexities of international business payments while empowering remote teams with seamless financial solutions.

Understanding Coyyn.com Business Platform

Coyyn.com business operates as a comprehensive digital platform that enables companies to manage payments, projects, and online finances through blockchain technology. Unlike traditional banking systems that rely on multiple intermediaries, the platform uses decentralized finance principles to facilitate safe, quick, and transparent transactions.

The platform specifically targets businesses struggling with conventional cross-border payment methods. Small businesses and startups benefit from digital invoicing, expense tracking, and integrated payment systems that consolidate all necessary tools for success. For companies managing international contractors, freelancers, or remote employees, coyyn.com business eliminates the friction points that have long plagued global payroll operations.

Core Features for Business Operations

The platform delivers several key capabilities that distinguish it from traditional financial services:

Multi-Currency Support: Global payments allow users to send money across borders easily without currency changes or high bank charges. Businesses can handle transactions in multiple currencies, reducing exposure to exchange rate fluctuations while maintaining flexibility in international operations.

Blockchain-Based Security: The platform maintains secure payments through blockchain technology and smart contracts, with businesses managing funds directly through decentralized wallets. This architecture enhances transparency and minimizes errors common in traditional payment systems.

Automated Processing: Invoicing uses automation to handle billing without manual work, with systems sending bills on time and tracking payments while sending reminders when needed. This automation frees finance teams to focus on strategic activities rather than administrative tasks.

Why Remote Teams Need Specialized Payment Solutions

Traditional banking infrastructure was never designed for the modern remote work economy. Companies managing distributed teams face several persistent challenges that conventional financial systems struggle to address.

The Cross-Border Payment Problem

International payments remain dominated by manual inputs and multi-step approvals, with companies collecting invoices via email, validating banking details by hand, and setting up each transfer individually. These operational patterns create inefficiency that grows exponentially as team size increases.

The infrastructure issue runs deeper than mere inconvenience. Most underlying rails are built on legacy infrastructure not designed for global teams with high-volume cross-border payroll flows, with international transfers still traveling through long correspondent banking chains where each intermediary adds time, fees, and potential failure points.

For remote professionals, payment reliability directly impacts their financial stability and employment decisions. Research shows 63% of freelancers wait over 30 days for payment, with a majority citing these delays as their top source of financial stress. When payments arrive late or are reduced by unexpected fees, trust erodes and retention becomes problematic.

Financial Impact on Business Operations

The cost of inefficient cross-border payments extends beyond transaction fees. Businesses face:

- Hidden Charges: Traditional banks often apply opaque fee structures with multiple intermediaries taking cuts

- Exchange Rate Markups: Unfavorable conversion rates that can consume 3-7% of transaction value

- Processing Delays: Multi-day settlement periods that complicate cash flow management

- Administrative Burden: Manual reconciliation requiring significant staff time and creating error opportunities

For perspective, if a business moves $2,000 monthly and reduces transaction losses from 7% to 2%, they essentially give themselves a $100 monthly increase—$1,200 annually—without acquiring new clients. These savings compound significantly for companies with larger payrolls or multiple international contractors.

How Coyyn.com Business Solves Cross-Border Payment Challenges

The platform addresses these pain points through technological innovation and user-centric design focused on the specific needs of businesses with distributed teams.

Speed and Efficiency Advantages

Cross-border payments feature competitive fees ranging from 0.5% to 2.1% with faster transaction times compared to traditional banking wire transfers. This speed differential transforms operational reality for both businesses and workers.

Payment processing typically completes in hours or sometimes minutes, significantly faster than the 2-5 business days typical with traditional banks. This acceleration improves cash flow predictability and reduces the financial stress remote workers experience when waiting for compensation.

Smart Contract Implementation

One of the platform’s most innovative features involves automated payment execution. Smart contract integration empowers users to automate financial agreements—these contracts are self-executing and tamper-proof, ensuring terms are honored automatically once predetermined conditions are met.

For businesses, this means:

- Milestone-Based Payments: Funds release automatically when contractors complete defined project stages

- Reduced Disputes: Clear, immutable contract terms eliminate payment disagreements

- Time Savings: No manual verification or payment authorization required for routine transactions

- Enhanced Trust: Both parties see transparent, verifiable payment conditions

Smart contracts eliminate payment disputes and reduce reliance on third parties, saving both time and money while increasing trust between transaction parties.

Multi-Asset Management

Multi-asset support allows handling many types of digital money in one location, enabling users to work with Bitcoin, Ethereum, stablecoins, and more without switching applications. This flexibility proves particularly valuable for businesses operating in regions where traditional banking access remains limited or expensive.

Companies can maintain operational funds in stable currencies while offering payment options that work best for individual team members based on their location and preferences.

Practical Applications for Remote Team Management

Understanding how coyyn.com business functions in real-world scenarios helps illustrate its value proposition for companies with distributed workforces.

International Contractor Payments

The platform enables cross-border transactions, multi-currency payments, and remote or international freelancing payment arrangements. For businesses regularly engaging contractors across multiple countries, this creates a unified payment infrastructure that replaces juggling multiple services or banking relationships.

Consider a software company with developers in the Philippines, designers in Brazil, and project managers in Eastern Europe. Rather than navigating three different payment systems with varying fees and processing times, the business processes all payments through a single platform with consistent, transparent pricing.

Payroll Automation for Distributed Teams

Both small agencies and solo freelancers use the platform—small agencies for cross-border payroll and solo freelancers for project payments. The system scales from individual payments to comprehensive payroll management without requiring different tools or processes.

Businesses can establish recurring payment schedules that execute automatically based on employment agreements or project milestones. Finance teams set parameters once, then the system handles ongoing payments with minimal intervention required.

Expense Tracking and Budget Management

Business tools include digital invoicing, expense tracking, and integrated payment systems. These capabilities consolidate financial operations into a cohesive ecosystem rather than requiring data synchronization across multiple platforms.

Real-time visibility into expenses, pending payments, and budget consumption enables more responsive financial management. Decision-makers can identify potential cash flow issues before they become critical and adjust operations accordingly.

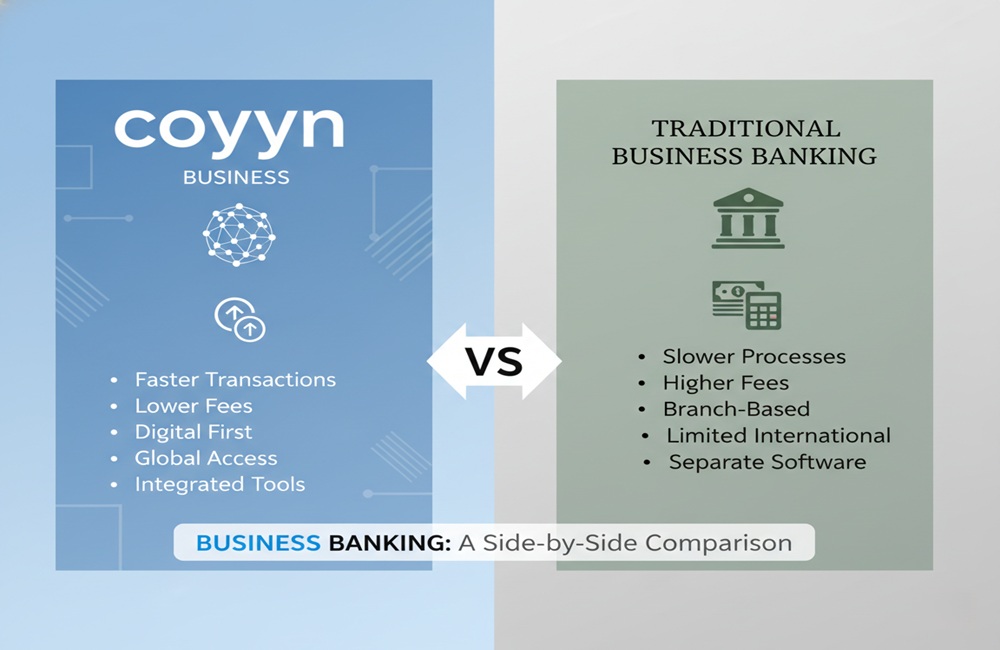

Comparative Analysis: Coyyn.com Business vs Traditional Solutions

| Feature | Coyyn.com Business | Traditional Banks | Typical Payment Platforms |

|---|---|---|---|

| Transaction Speed | Hours to minutes | 2-5 business days | 1-3 business days |

| Fee Structure | 0.5% – 2.1% | 3-7% + hidden fees | 2-5% |

| Currency Support | Multiple fiat + crypto | Limited to major currencies | Major currencies only |

| Automation | Smart contracts available | Manual processing | Limited automation |

| Transparency | Blockchain-verified | Opaque intermediaries | Moderate transparency |

| Setup Complexity | Moderate (digital-first) | High (paperwork intensive) | Low to moderate |

| Geographic Reach | Global including underserved regions | Variable by bank | Limited in some regions |

This comparison reveals coyyn.com business’s competitive positioning, particularly in speed, cost, and geographic accessibility—factors that directly impact businesses managing remote teams across diverse locations.

Security and Compliance Considerations

Financial security remains paramount when managing business payments, especially across international boundaries where regulatory frameworks vary significantly.

Blockchain-Based Security Architecture

Security and transparency are at the platform’s core, with sensitive information encrypted and smart contracts plus two-factor authentication providing secure and dependable payment solutions. The blockchain foundation creates an immutable transaction record that enhances accountability while maintaining privacy.

Unlike traditional systems where payment data passes through multiple institutions creating vulnerability points, decentralized architecture reduces exposure to single points of failure or data breaches.

Regulatory Compliance

Compliance represents one of the hardest aspects of paying international contractors, with each jurisdiction having unique requirements for anti-money laundering, sanctions, and tax reporting. Leading platforms address this through automated verification systems.

Solutions integrate automated Know Your Customer and Know Your Business checks, verifying identities of both senders and receivers, flagging risky transactions, and generating compliant documentation. This automated compliance reduces legal risk for businesses while simplifying the administrative burden of international operations.

Best Practices for Secure Operations

Businesses implementing coyyn.com business should follow security protocols to maximize protection:

- Enable Two-Factor Authentication: Add an additional security layer beyond password protection

- Start with Limited Amounts: Test the platform with smaller transactions before committing full payroll

- Maintain Transaction Records: Keep detailed documentation for accounting and compliance purposes

- Regular Security Audits: Periodically review access permissions and transaction patterns

- Diversify Payment Methods: Don’t rely exclusively on a single platform for all financial operations

Getting Started with Coyyn.com Business

Implementation begins by registering on the platform and verifying credentials as required, then setting up digital wallets or linking payment methods for both fiat and crypto depending on preferences.

Initial Setup Process

- Account Creation: Register business information and complete identity verification procedures

- Wallet Configuration: Establish digital wallets for currencies relevant to your operations

- Team Integration: Add team members or contractors who will receive payments

- Payment Method Linking: Connect funding sources for outgoing payments

- Automation Rules: Configure smart contracts for recurring payments or milestone-based releases

Integration with Existing Systems

The platform provides integration APIs that allow developers to seamlessly connect services into existing apps, websites, and business platforms, creating custom financial solutions tailored to specific business needs.

For companies with established accounting software, ERP systems, or project management tools, API integration ensures data flows between systems without manual entry. This connectivity reduces errors and maintains consistency across financial records.

Transitioning Remote Team Payments

When migrating from existing payment methods, consider a phased approach:

Phase 1: Begin with new contractors or a subset of remote team members willing to test the platform

Phase 2: Expand to additional team members as comfort and familiarity increase

Phase 3: Fully transition remaining payments while maintaining backup options during the adjustment period

This gradual implementation minimizes disruption while allowing businesses to validate the platform meets their specific requirements.

Cost-Benefit Analysis for Remote Team Payments

Understanding the financial implications helps businesses make informed decisions about platform adoption.

Direct Cost Savings

Transaction fees are generally lower than PayPal or Payoneer, preventing the loss of 5-10% of earnings to hidden charges. For a business with $50,000 in monthly international payroll, reducing fees from 5% to 1.5% saves $1,750 monthly or $21,000 annually.

Indirect Benefits

Beyond direct fee reduction, businesses gain value through:

Improved Team Satisfaction: Paying international contractors on time in their local currency improves retention and trust. Reduced payment friction translates to higher employee satisfaction and lower turnover.

Administrative Efficiency: Automation reduces the time finance teams spend processing payments, allowing reallocation to higher-value activities.

Enhanced Cash Flow Visibility: Real-time tracking and transparent fee structures improve financial planning accuracy.

Expanded Talent Access: The platform particularly shines in regions where PayPal often blocks or limits access, including areas across Africa, Asia, and Eastern Europe. This expanded reach allows businesses to recruit from broader talent pools.

Limitations and Considerations

While coyyn.com business offers substantial advantages, businesses should understand potential constraints before fully committing.

Platform Maturity

As a relatively newer entrant in the digital finance space, the platform has a shorter operational history than established alternatives. Potential risks include regulatory variability depending on location, cryptocurrency price volatility for users holding digital assets, limited long-term track record, and digital-only customer support.

Learning Curve

The user experience is closer to using PayPal than managing crypto wallets, making it accessible for most users. However, businesses unfamiliar with digital wallets or blockchain technology may require orientation time.

Geographic Availability

While the platform supports many regions, service availability and feature sets may vary by location based on local financial regulations. Businesses should verify full functionality in their operating jurisdictions before committing.

Alternative Considerations

Alternatives might include using specialized, established services instead of one all-in-one platform, such as traditional payment processors combined with separate accounting or customer relationship management software, or well-established crypto wallets or exchanges for digital asset management.

Future Outlook for Cross-Border Business Payments

The landscape of international payments continues evolving rapidly as technology advances and remote work becomes increasingly normalized.

Emerging Technologies

New technologies like AI and improved networks will shape the digital economy, with AI able to predict trends and automate more functions while faster blockchain networks enable even quicker transactions. These developments promise continued improvement in speed, cost, and reliability for cross-border payments.

Regulatory Evolution

Integration with traditional finance systems is key for the future, meaning easy conversions between crypto and cash, with banks potentially adding platform links for seamless transfers guided by regulations for safety. As regulatory frameworks mature, hybrid systems combining traditional and digital finance will likely become more common.

Market Positioning

The platform positions itself as a solution for international payments and cross-border transfers with global payment capability benefiting freelancers, remote workers, international businesses, and anyone needing efficient money transfers across countries without traditional banking delays.

As remote work becomes permanent rather than temporary for many organizations, demand for efficient cross-border payment solutions will only increase. Platforms that successfully balance innovation with reliability and regulatory compliance will capture growing market share.

Conclusion: Strategic Considerations for Remote Team Management

Managing cross-border payments represents one of the most persistent operational challenges for businesses with distributed teams. Traditional banking infrastructure, designed for a different era of commerce, struggles to meet the speed, cost, and transparency requirements of modern global operations.

Coyyn.com business emerges as a purpose-built solution addressing these specific pain points through blockchain technology, smart contract automation, and multi-currency support. The platform delivers measurable advantages in transaction speed, cost reduction, and operational efficiency compared to conventional alternatives.

For businesses evaluating the platform, the decision framework should consider:

- Scale of International Operations: Companies with significant cross-border payment volume realize the greatest cost savings

- Team Distribution: Businesses with team members in regions underserved by traditional platforms gain access advantages

- Technical Capacity: Organizations comfortable with digital-first financial tools will find implementation smoother

- Risk Tolerance: Companies should balance innovation benefits against platform maturity considerations

The strategic value extends beyond immediate cost savings. Efficient, reliable payment systems strengthen relationships with remote team members, reduce administrative burden on finance teams, and provide the operational flexibility necessary for global growth.

As the remote work economy continues expanding, businesses that establish robust cross-border payment infrastructure position themselves advantageously for accessing global talent and scaling international operations. Coyyn.com business represents one path toward building that capability, offering a comprehensive platform designed specifically for the challenges modern distributed teams face.

Whether coyyn.com business becomes a company’s primary payment solution or complements existing systems, understanding its capabilities and limitations enables better-informed decisions about managing the financial complexity inherent in remote team operations. The future of work is undeniably global—and the infrastructure supporting that future must evolve accordingly.