Modern startups face a critical challenge: managing finances efficiently while scaling rapidly. Traditional banking systems, with their hidden fees and slow processing times, often hold back growth. Enter coyyn.com business—a decentralized finance platform designed specifically for the realities of startup life in 2026.

What is Coyyn.com Business?

The coyyn.com business platform operates as a comprehensive decentralized finance (DeFi) ecosystem built on blockchain technology. Unlike traditional financial institutions that control your funds and data, this platform gives users complete ownership through decentralized wallets and smart contracts.

The technology addresses common startup pain points: slow payment processing, high transaction fees, limited access to global markets, and complex compliance requirements. By leveraging blockchain infrastructure, businesses gain real-time transaction visibility and immutable record-keeping that traditional systems cannot match.

The Complete Coyyn.com Business Finance Stack

Decentralized Wallets: Your Financial Foundation

These digital wallets represent the cornerstone of the platform. Unlike bank accounts controlled by financial institutions, decentralized wallets give businesses complete custody of their assets through private key ownership.

The security model uses 256-bit encryption to protect data and transactions. For startups managing global teams or international clients, these wallets eliminate cross-border payment complications. Companies can set up multiple wallets for different departments while retaining centralized oversight.

Multi-Asset Support for Global Operations

The coyyn.com business platform supports Bitcoin, Ethereum, stablecoins, and various other digital assets within a single interface. This capability eliminates the need for multiple exchange accounts and reduces conversion fees.

Startups can accept payments in their customers’ preferred currencies and convert them instantly to stablecoins or traditional crypto assets. The platform handles cross-chain transactions smoothly, allowing assets to move between different blockchain networks without manual intervention.

Smart Contract Automation

Smart contracts bring unprecedented automation to financial operations. These self-executing agreements run automatically when predefined conditions are met, removing manual processing from routine transactions.

Startups can program automatic payments to contractors upon project completion, process invoice payments when products ship, and handle subscription renewals without human intervention. This reduces administrative overhead and eliminates payment delays.

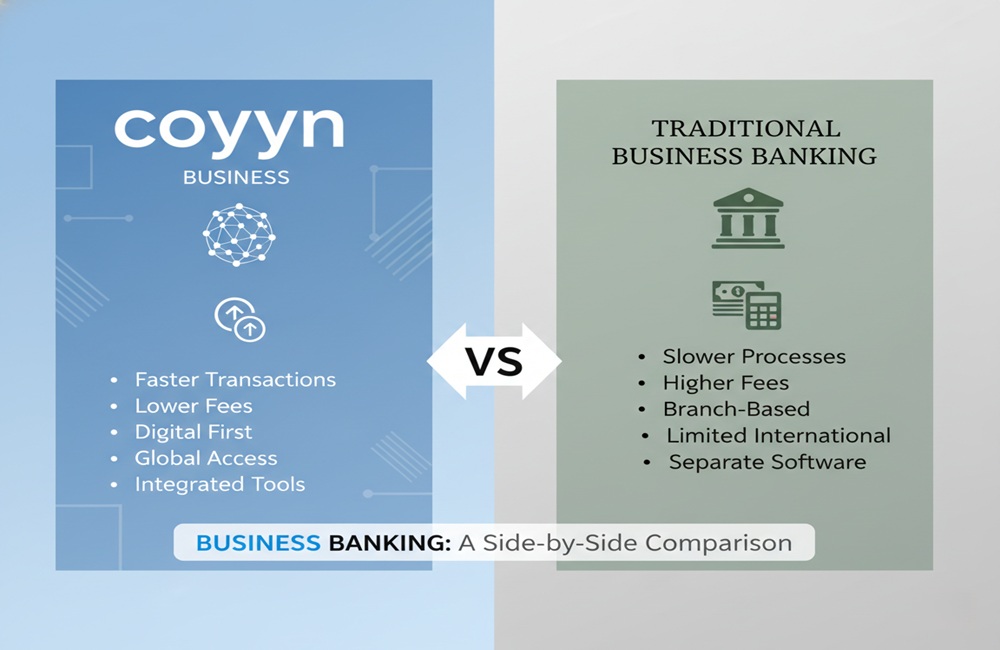

How Coyyn.com Business Compares to Traditional Finance

| Feature | Traditional Banking | Coyyn.com Business | Impact |

|---|---|---|---|

| Transaction Speed | 3-5 business days | Real-time to minutes | Faster cash flow |

| International Fees | 3-7% per transfer | 0.1-1% | Major cost savings |

| Account Control | Centralized | User-controlled | Complete ownership |

| Operating Hours | Business hours | 24/7/365 | Continuous operations |

| Setup Time | 2-4 weeks | Minutes to hours | Rapid deployment |

Essential Features for Startup Operations

Automated Invoicing and Payments

The platform streamlines accounts receivable through intelligent automation. Create invoice templates, set recurring billing schedules, and automatically send payment reminders. When customers pay, the system records transactions automatically and updates accounting records in real-time, eliminating manual data entry.

Real-Time Financial Reporting

Access to current financial data drives better decisions. The coyyn.com business provides dashboards showing asset balances, transaction history, and spending patterns across all accounts and currencies. These insights help startups track burn rate, monitor runway, and identify spending trends before they become problems.

Compliance and Tax Management

The platform includes tools for tracking taxable events, generating required forms, and maintaining audit trails. The system automatically categorizes transactions, calculates tax liabilities, and produces reports formatted for different jurisdictions, saving accounting hours and reducing regulatory risk.

Building Your Startup Finance Stack

Integration with Existing Tools

Most startups already use accounting software like QuickBooks or Xero. The coyyn.com business platform integrates with these systems through API connections, allowing transaction data to flow automatically from crypto wallets to accounting ledgers.

This hybrid approach lets startups leverage DeFi benefits while maintaining compatibility with standard accounting practices investors and auditors expect.

Hybrid Finance Stack Approach

| Stack Component | Traditional Tool | Coyyn.com Business Role | Combined Benefit |

|---|---|---|---|

| Accounting | QuickBooks, Xero | Transaction data feed | Unified records |

| Payments | Stripe, PayPal | Crypto payment option | Multi-channel revenue |

| Payroll | Gusto, Deel | International payments | Global team support |

| Banking | Mercury, SVB | Digital asset custody | Diversified treasury |

Real-World Use Cases

International Team Payments

A software startup with developers in five countries faces significant payroll challenges through traditional banking. International wire transfers cost $30-50 per transaction and take 3-5 days to clear.

Using the coyyn.com business platform, the company sets up automated bi-weekly payments in stablecoins. Contractors receive funds instantly without conversion fees or bank delays. Annual savings: approximately $15,000 in transfer fees plus 20 hours monthly of administrative time.

Customer Payment Flexibility

An e-commerce startup adds crypto payment processing alongside existing Stripe integration. Customers choosing crypto payments bypass credit card processing fees (2.9% + $0.30). The platform automatically converts received crypto to stablecoins, protecting against volatility while reducing transaction costs.

Treasury Management

A well-funded startup allocates a portion of treasury to stablecoins through the coyyn.com business platform. These funds remain liquid for operational needs while earning competitive yields through DeFi protocols. The platform’s multi-asset support allows diversification across different stablecoin providers, reducing concentration risk.

Security and Risk Management

The coyyn.com business implements multiple security layers:

Encryption: All data uses 256-bit encryption matching banking industry standards

User-Controlled Keys: Non-custodial wallets eliminate platform-wide hack risks

Transaction Verification: Blockchain provides immutable, verifiable records

Access Controls: Role-based permissions and multi-signature wallets prevent unauthorized transactions

Implementation Best Practices

- Start with a portion of operating funds rather than complete treasury migration

- Ensure financial staff understand blockchain basics and security protocols

- Securely store private key backups in multiple physical locations

- Require multiple approvals for transactions exceeding defined thresholds

- Review access permissions and transaction patterns quarterly

Cost Analysis: Traditional vs. Coyyn.com Business

Traditional Finance Stack Monthly Costs:

- Business banking: $15-50

- Accounting software: $50-150

- Payment processing: 2.9% + $0.30 per transaction

- International transfers: $30-50 per transaction

- Payroll service: $40-150

- Average: $200-500 plus variable costs

Coyyn.com Business Platform:

- Transaction fees: 0.1-1% depending on network

- No international transfer premiums

- Integrated accounting included

- Average: $50-150 for typical startup volume

Startups processing $50,000 in monthly international transactions save approximately $1,500-3,000 monthly compared to traditional wire transfers.

Getting Started: Implementation Roadmap

Week 1: Foundation Setup

- Create account and complete identity verification

- Set up initial decentralized wallet

- Configure security settings and multi-factor authentication

Week 2: Integration and Testing

- Connect accounting software via API

- Set up payment acceptance for first cryptocurrency

- Create test transactions to verify workflow

Week 3: Pilot Program

- Process payroll for subset of team members

- Accept crypto payments from willing customers

- Monitor transactions and gather feedback

Week 4: Full Deployment

- Expand to full team payments

- Activate all payment methods

- Implement automated workflows for recurring transactions

Common Implementation Challenges

Challenge: Team unfamiliarity with cryptocurrency concepts

Solution: The coyyn.com business platform provides educational resources and onboarding support. Start with simple use cases like contractor payments before expanding to complex treasury management.

Challenge: Accounting integration complexity

Solution: Use pre-built connections to major accounting packages. For custom systems, API documentation enables developer implementation within days.

Is Coyyn.com Business Right for Your Startup?

Ideal Candidates

The coyyn.com business platform serves startups particularly well when:

Global teams: Instant, low-cost international payments benefit companies with contractors across multiple countries. Payments settle in minutes regardless of recipient location, proving invaluable for distributed teams across time zones.

Tech-forward customers: Businesses serving cryptocurrency users gain competitive advantage. E-commerce platforms, SaaS companies, and digital service providers find that offering crypto payments attracts valuable customer segments.

High transaction volumes: Significant fee savings at scale. Companies processing thousands of monthly transactions save substantial amounts by switching from traditional payment processors charging 2.9% to blockchain transactions at fractions of a percent.

Rapid growth: Infrastructure that expands without costly migrations. The coyyn.com business platform scales from single-user wallets to complex multi-signature treasury management without platform switches.

When to Consider Alternatives

Traditional finance remains appropriate for businesses in highly regulated industries with DeFi restrictions, teams lacking blockchain technical sophistication, or operations requiring immediate fiat currency access for all expenses.

Most successful implementations use a hybrid approach, leveraging both traditional banking and the coyyn.com business platform where each provides clear advantages.

The Future of Startup Finance

The intersection of traditional finance and decentralized systems continues evolving rapidly. AI-powered financial analysis provides predictive analytics on cash flow and spending patterns. Cross-border commerce simplification enables borderless business without traditional banking friction. Regulatory maturation brings clearer frameworks for cryptocurrency operations.

The coyyn.com business platform adapts to these changes while maintaining core benefits: speed, transparency, and cost efficiency that give startups competitive advantages in global markets.

Competitive Advantages

Speed and Efficiency: The platform eliminates inefficiencies through 24/7 automated operations. Smart contracts execute instantly when conditions are met, removing human delays from routine transactions.

Transparency and Trust: Blockchain technology provides unprecedented transparency. Investors access real-time financial data rather than waiting for quarterly reports. External auditors verify blockchain records directly, reducing audit time and cost.

Cost Efficiency: The financial impact compounds significantly at scale. A startup processing $100,000 monthly in payments pays approximately $4,000 in traditional fees versus $500-1,000 using the coyyn.com business platform—representing annual savings of $30,000-42,000.

Conclusion: Building a Modern Finance Stack

The landscape of business finance transforms as blockchain technology matures and decentralized solutions prove their value. The coyyn.com business platform represents a practical approach to this evolution—augmenting traditional finance with superior tools for international transactions, automated workflows, and reduced costs.

Startups face enough challenges without financial infrastructure holding them back. By strategically incorporating the coyyn.com business into their finance stack, founders gain flexibility to pay global teams instantly, accept diverse payment methods, and automate routine financial operations.

Start small, test thoroughly, and scale strategically. The future of startup finance is here—decentralized, automated, and accessible to businesses of any size.