The financial landscape for businesses has transformed dramatically in recent years. While traditional banks have served businesses for centuries, digital platforms are rewriting the rules of business banking. Among these innovative solutions, coyyn.com business emerges as a comprehensive digital ecosystem designed specifically for modern enterprises, freelancers, and gig economy participants.

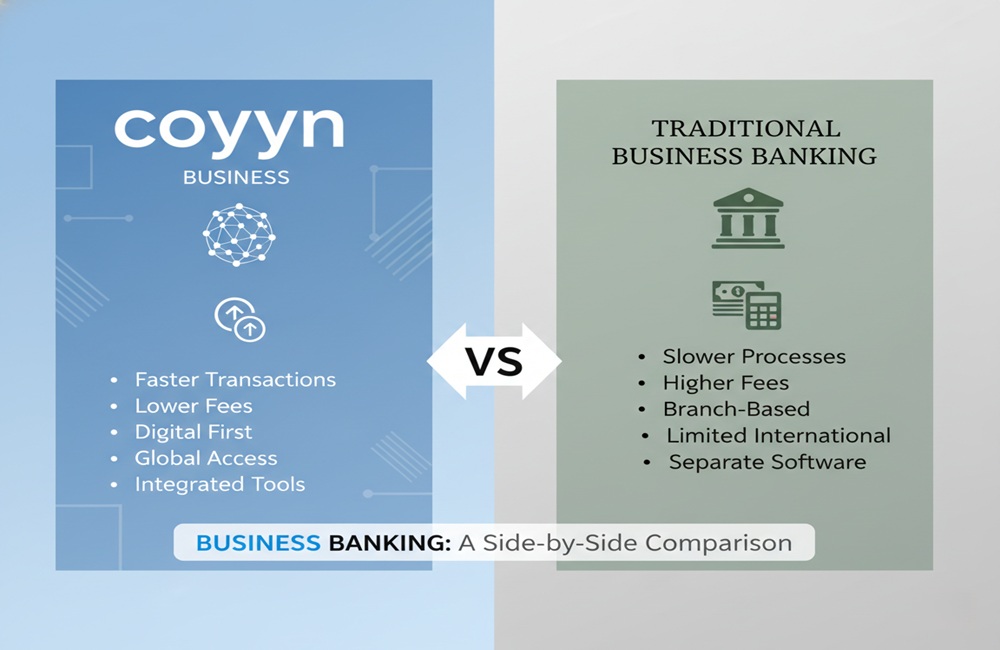

Understanding the differences between coyyn.com business and traditional business banking is crucial for making informed financial decisions that can save thousands of dollars annually while enhancing operational efficiency. This comprehensive comparison examines both options across key dimensions that matter most to business owners.

What is Coyyn.com Business?

Coyyn.com business is a digital financial platform that delivers an all-in-one solution designed to meet modern business needs with ease. Unlike conventional banks, this platform integrates digital banking, cryptocurrency management, and gig economy tools into a unified experience.

The platform serves as more than just a financial service provider. It helps companies of all sizes run smoother operations, with small teams using it to pay suppliers quickly while larger firms track expenses in real time. This reduces errors and saves considerable time on paperwork that traditional systems often require.

With seamless digital banking, secure transactions, and dedicated gig economy tools, users can easily handle multiple income sources, streamline payments, and stay in control of their finances. The platform particularly appeals to businesses operating in the digital-first economy where flexibility and speed are paramount.

Understanding Traditional Business Banking

Traditional business banking refers to financial services provided by established brick-and-mortar institutions with physical branch networks. These banks have operated for decades, offering in-person customer service, comprehensive lending products, and the familiarity of face-to-face interactions.

Traditional banks carry higher operational costs, which often translate to higher fees reflecting the expense of maintaining branch networks and staffing. However, they provide services that some businesses still find essential, particularly those dealing heavily in cash or requiring complex financial advisory services.

The traditional banking model operates on fixed schedules, typically Monday through Friday from 9 to 5, which can create challenges for busy entrepreneurs who struggle to find time during these limited hours.

Side-by-Side Feature Comparison

Core Banking Features

| Feature | Coyyn.com Business | Traditional Business Banking |

|---|---|---|

| Account Access | 24/7 digital access from anywhere | Limited to branch hours + online banking |

| Account Setup | Fully digital, minutes to complete | Requires branch visit, extensive paperwork |

| Mobile App | Advanced, feature-rich interface | Varies; often limited functionality |

| Transaction Speed | Instant, real-time processing | 1-3 business days for many transactions |

| Multi-Currency Support | Yes, including cryptocurrency | Limited to traditional currencies |

| Integration Capability | Seamless with business software | Often requires third-party solutions |

| Cash Handling | Limited physical cash services | Full cash deposit/withdrawal services |

| Customer Support | 24/7 digital support | Branch hours + limited phone support |

Cost Structure Comparison

The cost difference between coyyn.com business and traditional banking can significantly impact your bottom line.

| Cost Category | Coyyn.com Business | Traditional Business Banking |

|---|---|---|

| Monthly Maintenance Fee | Minimal to none | $10-$25 monthly |

| Minimum Balance Requirement | None or very low | Typically $3,000+ to avoid fees |

| Transaction Fees | Unlimited or generous allowances | $0.40-$0.50 per transaction after limit (often 150) |

| Wire Transfer Fees | Low or included | $25-$30 per transfer |

| Cash Deposit Fees | May require third-party services | Free up to $5,000, then $0.30 per $100 |

| ACH Transfers | Generally free | $5-$25 for expedited transfers |

| Foreign Transaction Fees | Minimal with crypto options | Up to 3% per transaction |

| Overdraft Fees | Often lower or eliminated | Around $30 per occurrence |

Industry studies suggest small and medium-sized businesses pay an average of $450-$600 annually in hidden costs with traditional banks. For businesses with modest cash reserves, these fees can meaningfully impact working capital.

Key Advantages of Coyyn.com Business

Comprehensive Digital Tools and Automation

Coyyn business includes automated invoicing where users create bills with a few clicks and send them out, with payments coming in faster thanks to built-in reminders. The platform provides robust analytics dashboards that track spending patterns, analyze trends, and help businesses make data-driven decisions.

Manual reconciliation with traditional banks typically requires about six hours per week for small and medium businesses, translating to an annual opportunity cost of over $31,000 in lost productive time. Coyyn.com business automates much of this reconciliation, integrates with common software platforms, and provides real-time updates that eliminate manual data entry.

Cryptocurrency Integration

One distinguishing feature of coyyn.com business is its native cryptocurrency support. By using crypto within business accounts, companies can explore new payment methods, adding options for international deals where traditional banks fall short. This integration allows businesses to accept payments in digital currencies and seamlessly convert between traditional and digital money.

Gig Economy and Scalability

For gig economy needs, businesses can pay freelancers directly through the platform. This streamlined approach eliminates complexity and delays often associated with contractor payments. The platform is built to scale as your company grows, without needing extra staff for finance tasks, adapting to needs from solopreneur to enterprise.

Enhanced Security and Compliance

Security plays a key role, using strong encryption to protect data during transactions. Regular updates keep the system protected against emerging threats, while multi-user access allows teams to collaborate on budgets. Coyyn business helps with compliance by tracking taxes and generating forms that meet legal needs, saving hours that would otherwise go to accountants.

Key Advantages of Traditional Business Banking

In-Person Relationship Banking

The primary advantage of traditional banking remains the ability to build face-to-face relationships with bankers. Traditional banks provide in-person customer service at their branches, enabling personalized guidance for complex financial situations.

Comprehensive Cash and Full-Service Solutions

If your business generates significant daily cash deposits—like retail stores, restaurants, or service businesses—traditional banking’s cash handling services become essential. Traditional banks offer convenient deposit options, change orders, and immediate access to deposited funds.

Lending options at traditional banks may be more robust, with established relationships improving access to business loans and lines of credit. Beyond basic banking, traditional institutions often provide merchant services, payroll processing, and business advisory services all under one roof.

Key Limitations to Consider

Coyyn.com Business Limitations

The digital-first nature means businesses dealing heavily in physical cash will need alternative solutions for deposits. Business owners accustomed to traditional banking may need time to adapt to the fully digital interface. The lack of in-person interaction may not suit those who value face-to-face financial advisory relationships.

Traditional Banking Limitations

Most branches operate limited hours, making it difficult for busy business owners to access services. Geographic limitations affect businesses that expand or relocate. While major banks offer polished apps, smaller regional banks may have clunky interfaces with limited features. Higher infrastructure costs translate to higher fees that reduce available working capital. Many transactions require 1-3 business days to process, impacting cash flow management.

Who Should Choose Coyyn.com Business?

Coyyn.com business is ideal for:

Digital-First Companies: Businesses operating primarily online with digital payment systems, remote teams, and minimal cash handling needs will find the platform perfectly aligned with their operations.

Gig Economy Participants: Freelancers, contractors, and businesses heavily utilizing gig workers benefit from the platform’s specialized tools designed specifically for flexible work arrangements.

Cost-Conscious Startups: New businesses watching every dollar will appreciate the minimal fees and lack of minimum balance requirements that preserve precious working capital during early growth stages.

International Businesses: Companies conducting cross-border transactions or working with international clients gain significant advantages from multi-currency support and cryptocurrency integration.

Tech-Savvy Entrepreneurs: Business owners comfortable with digital tools and mobile-first banking will maximize the platform’s advanced features and automation capabilities.

Fast-Growing Businesses: Companies experiencing rapid growth appreciate the platform’s ability to scale without requiring system migrations or additional finance personnel.

Who Should Choose Traditional Business Banking?

Traditional banking remains the better choice for:

Cash-Intensive Businesses: Retail stores, restaurants, event venues, and other businesses with significant daily cash deposits require the robust cash-handling infrastructure that traditional banks provide.

Businesses Seeking Lending: Companies planning to pursue business loans, lines of credit, or other financing products may benefit from the established lending relationships that traditional banks offer.

Relationship-Oriented Owners: Business owners who value in-person consultations for financial planning, complex transactions, or business advisory services will appreciate the face-to-face interaction.

Conservative Decision-Makers: Businesses preferring the familiarity and perceived stability of established banking institutions may feel more comfortable with traditional options.

Complex Service Needs: Companies requiring comprehensive services like merchant processing, payroll management, and retirement plans integrated with their banking may prefer one-stop traditional solutions.

Making the Right Choice for Your Business

The decision between coyyn.com business and traditional business banking isn’t always either-or. Many modern businesses adopt a hybrid approach, maintaining a traditional bank account for specific services while leveraging digital platforms for day-to-day operations.

Consider these questions when making your decision:

What are your primary banking activities? If you primarily handle digital transactions, a digital platform likely serves you better. If cash deposits dominate your daily operations, traditional banking may be necessary.

How do you value your time? The time saved through automation and digital efficiency can represent tens of thousands of dollars annually in opportunity cost for business owners focused on revenue-generating activities.

What’s your growth trajectory? Fast-growing businesses benefit from platforms that scale effortlessly, while established businesses with stable operations may prioritize relationship continuity.

How important are fees to your bottom line? For businesses with tight margins, the hundreds or thousands saved annually through lower fees can make a material difference to profitability.

Do you need specialized services? Cryptocurrency capabilities, gig economy tools, and advanced integrations may be decisive factors if they align with your business model.

The Future of Business Banking

Recent data shows that 64% of U.S. adults prefer mobile banking over traditional methods in 2025, up from 58% in 2023. Federal Reserve surveys found that 86% of businesses used faster or instant payments in 2023 to reduce costs, provide payment flexibility, and enable round-the-clock transactions. These preferences are reshaping the competitive landscape as traditional banks expand digital capabilities while platforms like coyyn.com business continue innovating.

Conclusion

Both coyyn.com business and traditional business banking offer distinct advantages tailored to different business needs. Digital platforms excel at efficiency, cost savings, automation, and modern features like cryptocurrency integration. Traditional banks provide in-person service, comprehensive cash handling, and established lending relationships.

The optimal choice depends on your specific business circumstances, operational model, and priorities. Many businesses find that combining both approaches—using digital platforms for everyday efficiency while maintaining traditional banking relationships for specific services—provides the best of both worlds.

Evaluate your specific requirements, calculate the true costs including both fees and opportunity costs, and choose the solution that empowers your business to operate at its highest potential. Business banking is not a one-size-fits-all decision.